Instant Payments in BGN – in live operation from this spring

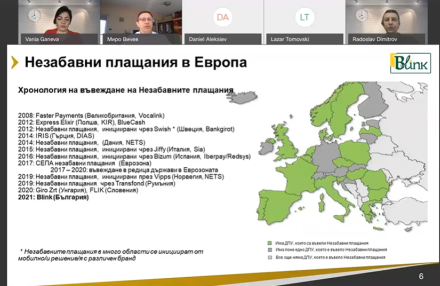

More than 2200 payment service providers in Europe are already offering instant payments. They account for 56% of the payment service providers on the Old Continent and 66% of those in the euro area. At the same time, instant payments hold a share of almost 6.5% of the total volume of payments, according to data of the European Payments Council. With these statistics Mr. Miroslav Vichev, Chief Executive Officer of BORICA AD, opened today the webinar on the project of development of an infrastructure for instant payments and their uptake in Bulgaria. "The official start of the instant payment service in Bulgaria is scheduled for 1 April 2021, and migration of batch payments to the new infrastructure is planned for September, this year", he clarified.

"The necessary amendments to the Law on Payment Services and Payment Systems in relation to the introduction of instant payments have already been completed, and BORICA’s license has been extended to include services of instant payments in levs up to BGN 100 000", as announced by Ms. Svetla Nikolova, Director of Payment Systems and Minimum Required Reserves at the BNB. For the purpose, consultations were held with the banks, a number of technical tests were conducted, and more of those are currently underway, and the settlement of instant payments to be executed by BORICA with funds provided in advance by the banks and held with the BNB has been regulated. To that effect, a special account will be opened at the Central Bank, protection of banks’ funds is in place, and rules of operation of RINGS are drawn up. "Instant payments are introduced as a result of the new digital reality and the needs of businesses", explained Svetla Nikolova. "The model implemented by BORICA is compliant with the pan-European scheme, and the duration of the service is set at 20 sec. from debiting the payer’s account to crediting the payee’s account. The banks’ task is to ensure conditions prompting the wide use of this service by customers." The key benefit of the instant payments system for merchants is the speed of payments, while the benefits for the banking institutions are in attracting customers by providing quick and innovative services and enhancing consumer experience, as well as facilitating the process of changeover to the euro in the future.

"The environment is installed and ready for execution of instant payments. The launch of a pilot project is forthcoming, and in the last quarter of the year – the migration of batch payments from the BISERA6 system to the new infrastructure where they will be processed at shorter intervals", clarified Ralitsa Toteva, Project Manager at BORICA AD. "The implementation of the Stand-In and Mobile Lookup solutions, conducting of tests and commissioning into live operation are yet to be completed", she added. Owing to the vast interest to the Mobile Lookup service, its launch, initially scheduled for 2022, was brought forward within the current year, as became clear during the seminar. The Mobile Lookup solution is a payment from a phone number, whereas the money is received within 10 seconds into the payee’s account, irrespective of the bank it is held with, and the solution itself is easy to integrate into the mobile banking of any bank. Stand-In is a centralised module aiding banks as a mediator between the bank’s main system and the centralised infrastructure that, on its part, ensures the continuity of the service, a uniform approach to integration with the main systems of the bank, and in the subsequent management of customer accounts and account balances. As Radoslav Dimitrov, Cards and Terminals Director at BORICA AD, explains its advantages, "the Stand-In solution provides a high speed of action for the business, eliminates the need for the bank to invest additionally in infrastructure, and scales down the costs of subsequent maintenance".

The additional services planned also include anti-fraud and AML (anti-money laundering) functionalities, which will assist banks significantly by relieving them from the workload in this area, as well as the development of the 4 Corner solution, for which a selection procedure is currently underway.

According to the legislation, within 2 years from the start of the instant payment service on 1 April 2021, all payment service providers should have ensured the availability of the service, i.e. they should be able to receive and process instant payments. "Presently, 4 banks have started a certification process for inclusion in the instant payments system", announced Vanya Ganeva, Business Development Manager at BORICA AD. As she said, every payment service provider should start a certification procedure when it is ready and in line with the deadlines, and the time for certification would depend on the provider’s readiness and the proper resource planning. After successful tests completion and issuance of a certificate, a provider may launch the service in live environment.

For banks to be included in the instant payments system, they should allocate funds into the special-purpose account held by the BNB, and the liquidity on this account will be maintained by managing 4 parameters – minimum limit, funds availability target, maximum limit and a holiday (incl. weekend days) surcharge.

The NCPS programme for instant payments through an account was presented by Stoilka Arsova, Director of the National Card and Payment Scheme (NCPS). "In relation to the new roles of NCPS full-membership participants, signing of a scheme participation agreement and a consent for accession to the programme for instant payments through an account is forthcoming", she explained. Separately, working meetings to discuss the rules on disputed payments are to start from the beginning of March, and in another three months the concept and strategy for the service of mobile payment at a POS terminal is to be presented.

"By launching the instant payments system BORICA will open new business opportunities for banks, and they, on their part – to their customers", commented Miroslav Vichev in conclusion.